Is vaping considered smoking for insurance purposes since they are lower in toxins than tradition tobacco cigarettes? The short answer is no.

Is vaping considered as smoking by insurance companies?

Is vaping considered to be smoking for insurance purposes? On the whole, yes. Most insurance providers will class vaping as the same as smoking. So, you could still invalidate your policy if you tick the ‘non-smoker’ box on your life insurance policy and it turns out you’ve been using e-cigarettes.

Is vaping really a harmless alternative to tobacco?

Touted as a harmless alternative to smoking, vape shops have even been opened in some NHS hospitals as part of efforts to eradicate smoking and the health risks associated with it. Public Health England insists vaping is 95 per cent safer than using cigarettes.

Why vaping is a good alternative to smoking?

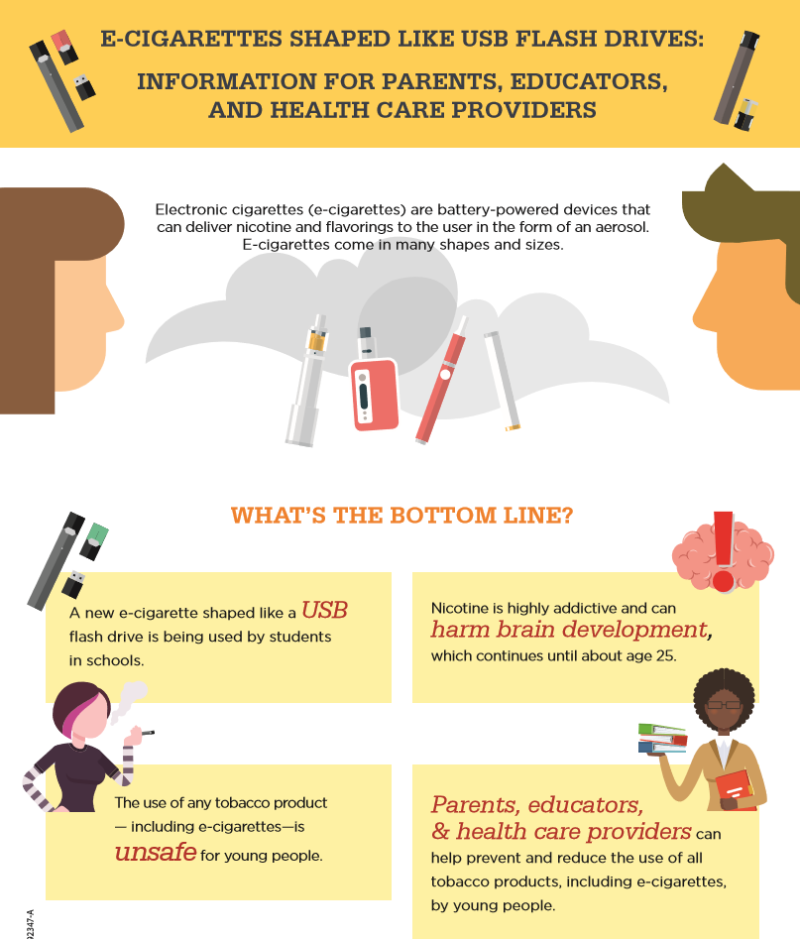

Vaping is the cultural phenomenon that became popular in the late 2000s, when tough anti-smoking campaigns made people more aware of the serious health risks posed by smoking tobacco. Vaporizers were billed as a great way to quit, and people took it up in their droves. Since then, e-cigarettes have been a fixture on the ]

Is vaping considered smoking by law?

Is vaping considered smoking by law? Regulation of electronic cigarettes depends on the state. The possession of electronic cigarettes and other vaping devices differ from state to state across the US. The Food and Drug Administration (FDA) regulated e-cigarettes and vaporizers as tobacco products. The list also includes vaporizers and other ...

Is e-cigarette the same as traditional cigarettes?

Does insurance raise premiums for vaping?

Is Vaping Considered Smoking for Insurance Purposes?

What is considered tobacco use for health insurance?

According to the federal Department of Health and Human Services, insurance companies consider folks tobacco users if they use tobacco products – including cigarettes, cigars, pipe tobacco, and chewing tobacco – on average four or more times a week during the past six months.

What happens if you lie about vaping on life insurance?

If the death benefit is paid out, the amount will more than likely be reduced. Your policy could even be labeled fraudulent, and your beneficiaries would deal with the consequences. Failing to disclose a habit or illness to secure better insurance rates is considered insurance fraud.

How do insurance companies know if you vape?

The healthier you are and the less complicated your family medical history, the lower your premiums will be. Most insurers classify e-cig use as tobacco use because vape juice often contains nicotine, which providers test for during the medical exam.

Does health insurance go up if you vape?

Health Insurance Companies Can Charge People Who Vape Up to 50% More.

What happens if you lie to insurance company about smoking?

If you report inaccurate or false information about your tobacco use on an application, an insurer is allowed to retroactively impose the tobacco surcharge to the beginning of the plan year. However, the insurer is not allowed to cancel your coverage because of the false or incorrect information.

Can life insurance find out you smoke?

Q: Do life insurance companies randomly test for tobacco use? A: No. But it's likely they will test your blood, urine, or saliva (via a mouth swab) before approving your application. And those tests will detect nicotine in your system if you've smoked or used other tobacco products recently.

How do life insurance companies determine if you smoke?

How do insurance companies find out if I smoke? Not telling an insurance company that you smoke or smoked when you apply for coverage can have an impact on the final benefit. They will find out, and they use various ways to verify the medical information you provide: Medical exams and questionnaires.

Do you have to disclose smoking for life insurance?

When you apply for life insurance, you will be asked to disclose whether you smoke, and if so, what type of tobacco products you use. Because the mortality rate for smokers is roughly three times higher than non-smokers, you can expect to pay a much higher life insurance premium if you use tobacco.

When should I tell my insurance provider I have given up smoking?

Usually, insurance providers will need you to have quit smoking for at least 12 months before they’ll class you as a non-smoker, but check with you...

Should I tell my insurance provider I have switched to e-cigarettes?

Most insurance providers class e-cigarette users as smokers, because e-cigarettes are still nicotine products and long-term health effects haven’t...

Why don’t insurance providers reward vaping if it helps me quit smoking?

Because the jury’s still out on the long-term health effects of vaping, it’s usually classed in the same bracket as smoking. But you could find pro...

How will my life insurance provider know if I am a smoker?

When you apply for life insurance cover, you’ll be asked if you’re a smoker or have ever smoked. You might need to take a medical exam, which will...

What happens if I start smoking or vaping after I get life insurance?

Your policy is based on the information you provide when you apply, but a few providers might ask you to tell them if you start smoking after you’v...

What type of life insurance should I get if I smoke?

There’s no particular best type of life cover for smokers – what’s right for you will depend on your personal circumstances. Options include: Level...

Where can I get a life insurance quote as a smoker?

Comparing with Compare the Market should help you find a policy that suits your lifestyle and meets the needs of you and the people you love. Start...

Is vaping considered smoking? - Vape Royalty

Are you thinking of switching from smoking to vaping? Then you probably are wondering what is the difference between smoking and vaping and what kind of benefits are waiting for you.Let’s find out what science says about this matter! Table of contents. What is smoking?

How do smoking and vaping affect life insurance? - comparethemarket.com

It’s no surprise that insurance providers view smokers as high risk. Our clear guide will explain the difference between smoking and vaping when it comes to life insurance, and how it affects the cost of your cover.

E-Cigarettes, Vaping And Life Insurance (Get Non-Smoker Rates!)

Nope, this is not a typo. Nope, you are not dreaming. So, what’s the catch?This is too good to be true, right? You are only eligible for non-smoker rates if you haven’t touched a cigarette in the last 365 days – but you have to disclose your use of cigars or other forms up front.. Some companies are more strict with their conditions, mandating no less than 2 years smoke-free before ...

Are vapes tobacco products? - Vape Royalty

Rest of the world. How does the situation look in other countries? Well, it depends, of course. For example, in Europe, e-cigarettes are under The Tobacco Products Directive, which also sees them as tobacco related products.

What is the biggest misconception about vaping?

As would be expected, one of the greatest misconceptions about vaping and life insurance is the rate class you can be approved for.

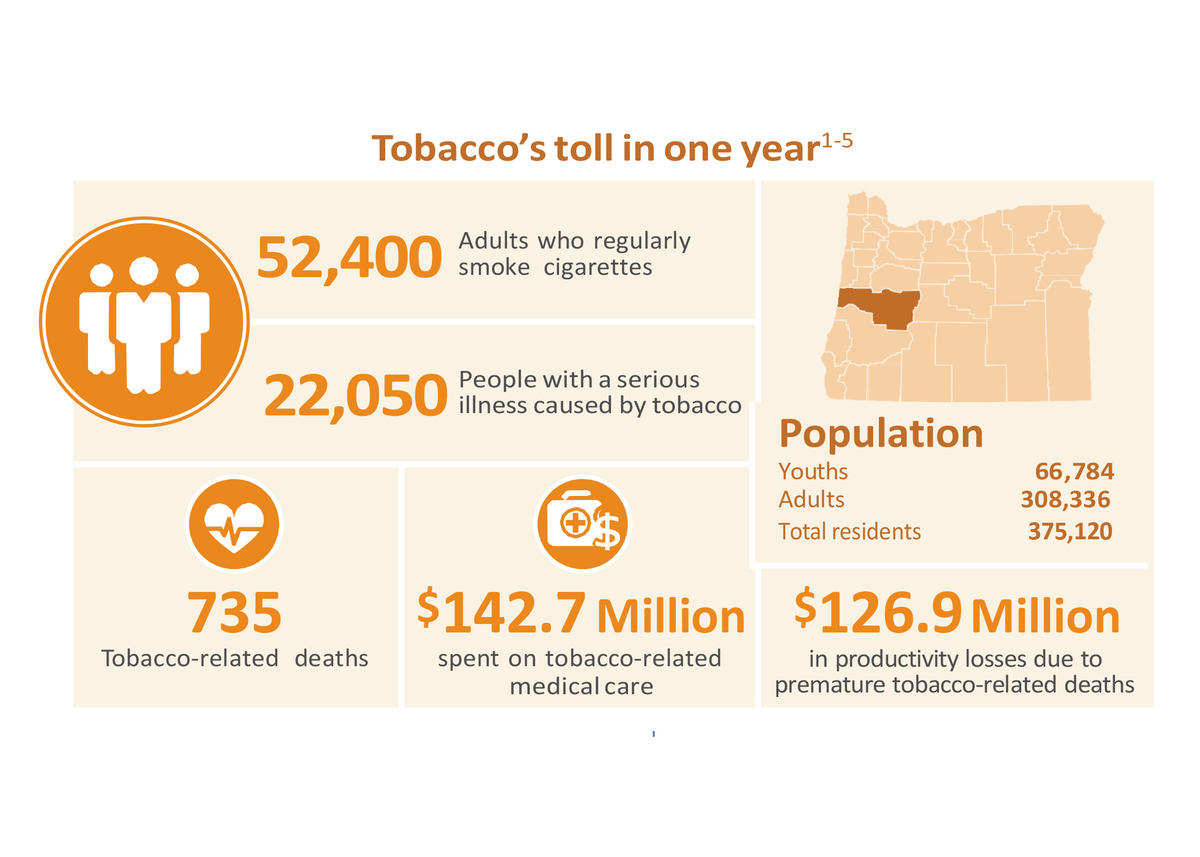

Why is life insurance so expensive for smokers?

Life insurance for smokers is so much more expensive because this decrease in longevity is up to 10 years. Most insurance companies would consider this drop in longevity not only a significant risk, but also a huge liability concern.

What to do if you cut back on vaping?

If you’ve cut back on your vaping habits or quit cold turkey, inform your agent immediately.

How long do you have to smoke to be eligible for non-smoker rates?

Some companies are more strict with their conditions, mandating no less than 2 years smoke-free before becoming eligible.

What happens if you don't disclose your illness to your insurance company?

Failing to disclose a habit or illness to secure better insurance rates is considered insurance fraud.

Is e-cigarette a tobacco product?

However, in 2016, the FDA determined that e-cigarettes, or Electronic Nicotine Delivery Systems (ENDS), are considered tobacco products and subject to federal regulation. This is why so many vapers experience smoker rates when it comes to life insurance coverage. Nonetheless, this is great news for e-cigarette users, ...

Is vaping a slam dunk?

Nonethe less, this is great news for e-cigarette users, because it’s obviously not a slam dunk case to call vaping tobacco use.

What if I don’t tell an insurance provider that I smoke or vape?

Failing to inform your insurance provider that you smoke or vape is classed as ‘material misrepresentation’.

How does smoking affect life insurance?

Regardless of your age or whether you’ve been a short-term or long-term smoker, being classed as a smoker will make a big difference to how much you pay for life insurance.#N#Statistically, smokers are more at risk of suffering from ill health or dying at a younger age, which means life insurance providers are more likely to have to pay out on a claim. That explains why you’re charged a higher premium if you’re a smoker.#N#It’s estimated that for a 30-year-old smoker, premiums will be around a third higher, while for a 50-year-old it could be up to double the cost of non-smokers of the same age.#N#When working out how much to charge you for life insurance, providers will look at: 1 What you smoke (for example, cigarettes, pipe, e-cigarettes) 2 How many years you’ve smoked 3 Your overall lifestyle and physical fitness 4 If your health has already been affected by smoking

How long do you have to quit smoking before you can take out a non-smoking policy?

Usually, insurance providers will need you to have quit smoking for at least 12 months before they’ll class you as a non-smoker, but check with your provider first. Once you’ve let them know about your new status, you may need to have a medical test and provide a doctor’s report before you can take out a non-smoking policy.

How many people smoke in the UK?

You’re still a smoker as far as an insurance provider is concerned. Around 6.9 million adults in the UK smoke, according to the latest data from the Office for National Statistics.

How long do you have to be off nicotine?

Typically you’ll need to have been off all nicotine products for at least 12 months, before you qualify for any cheaper rates. Before offering you a cheaper premium, your provider might want to see evidence that you’ve quit the habit for good.

Can you get life insurance if you are a smoker?

When you apply for life insurance cover, you’ll be asked if you’re a smoker or have ever smoked. You might need to take a medical exam, which will test for a variety of things including nicotine in your system. Your insurance provider may also ask your GP for your medical records (with your consent), which may identify you as a smoker.

Does quitting smoking reduce life insurance premiums?

As well as making you healthier, quitting smoking can reduce the cost of life insurance premiums. But you won’t be able to amend smoking terms midway through your policy, which means you’ll need to take out a new policy instead.

Can insurance refuse to pay for tobacco?

If you get a tobacco-related illness and you test positive for tobacco, the insurance company has the right to refuse payment for service if you were taking the tobacco-free discount . That's why it asks you to reconfirm every year, so that no one can say "well, I filled that form out so long ago, I didn't remember to go and change my status."

Is a tobacco free affidavit included in vapes?

HOWEVER, once I got the process rolling, they presented the Tobacco-Free Affidavit to sign, and that document DOES specify that when they refer to "tobacco usage", they ARE including e-cigarettes and vape products .

When Does Tobacco Rating Apply?

Truly casual smokers may be able to avoid tobacco surcharges. Tobacco use must rise to a certain level before health insurance companies can penalize you.

What is the practice of demanding a surcharge for tobacco use?

Your tobacco use. The practice of demanding a surcharge for tobacco use is known as tobacco rating. Insurance companies and some experts justify the large surcharge acts as an incentive to convince smokers to quit.

How many people smoke in 2016?

Despite the deadly dangers of smoking — with lung cancer now the No. 1 cancer threat to men and women — 34 million Americans still smoke regularly (14% ) and another 6 million use vaping nicotine inhalers. The Federal Drug Administration labeled inhalers as “tobacco products” in 2016, and, therefore, so do most health insurers.

Why is it important to be truthful with your insurance company?

By being truthful with your insurance company, you can save yourself all sorts of onerous complications down the road.The potentially grave consequences for misrepresenting your tobacco use should convince you to always be transparent.

Can insurance investigate if you smoke?

Although it’s nearly unheard of for an insurer or employer to actively investigate whether you smoke, your doctor will probably note tobacco use in your medical records as a result of routine blood and urine analysis. That paper trail could be uncovered and flagged as your insurer is reviewing your treatment before paying your bills.

Do you have to understand the law if you smoke or vape?

With that ruling, you can say the old tobacco policies went up in smoke. So if you smoke or vape, you need to understand the legislation and the probable higher costs of your health insurance. Not to be cheeky, but you’ll pay through the nose.

Can you lose your insurance if you smoke?

If you’re not honest about tobacco, you risk being charged with insurance fraud. Even such “soft fraud” is considered a misdemeanor and can result in sentences of probation, community service — or even time in jail. Not to mention, you’ll very likely lose your insurance or at least be charged all the back money you owe as a smoker.

Can life insurance detect nicotine in urine?

For most life insurance carriers, you’ll find that the required medical exam to qualify for a policy can detect nicotine in your urine. This will most likely put you in the same boat as traditional cigarette smokers. Which means that the best non-smoker rate classes will probably not be in the cards if you’re vaping.

Does vaping smell like ashtray?

What we do know is that vaping has become increasingly popular. So while you probably won’t save big bucks on your life insurance anytime soon look on the bright side – you’ll no longer smell like an ashtray.

Is e-cigarette the same as traditional cigarettes?

Based on the FDA’s definition, traditional cigarettes and e-cigarettes are in the same category. Insurance companies also take that into consideration and treat you the same as traditional smokers. This typically translates into you receiving higher insurance rates than non-smokers for your health and life insurance policies.

Does insurance raise premiums for vaping?

Although most insurance companies will raise your insurance premium regardless of if you are smoking or vaping, there are some carriers that provide rate relief for vaping. Check your state insurance department to find out which carriers view vaping favorably. EINSURANCE.com is an online insurance comparison website.

Is Vaping Considered Smoking for Insurance Purposes?

However, some studies show that smokers who use them are actually less likely to quit. Hence the question: is vaping considered smoking for insurance purposes, given electronic alternatives contain lower toxins than traditional tobacco cigarettes?