As of June 1, 2020, all vaping products are subject to a 75% state excise tax on the wholesale price. Payments of cigarette and tobacco excise tax are made by vendors, not by consumers. However, the cost of the excise will be included in the retail price.

What is the excise tax for vape products?

Pennsylvania has mandated for all vapor products an excise tax that is equal to 40% of the wholesale price. To read more about this tax, please click here. Virginia requires an excise tax of $0.066 per milliliter of nicotine in solution or other form intended for use in a nicotine vapor product.

What is Boulder’s vaping excise tax?

The city of Boulder requires on all vaping products, including tobacco-free nicotine products, an excise tax that is equal to 40% of the retail price. Learn more here.

Which state has the highest tax on vape products?

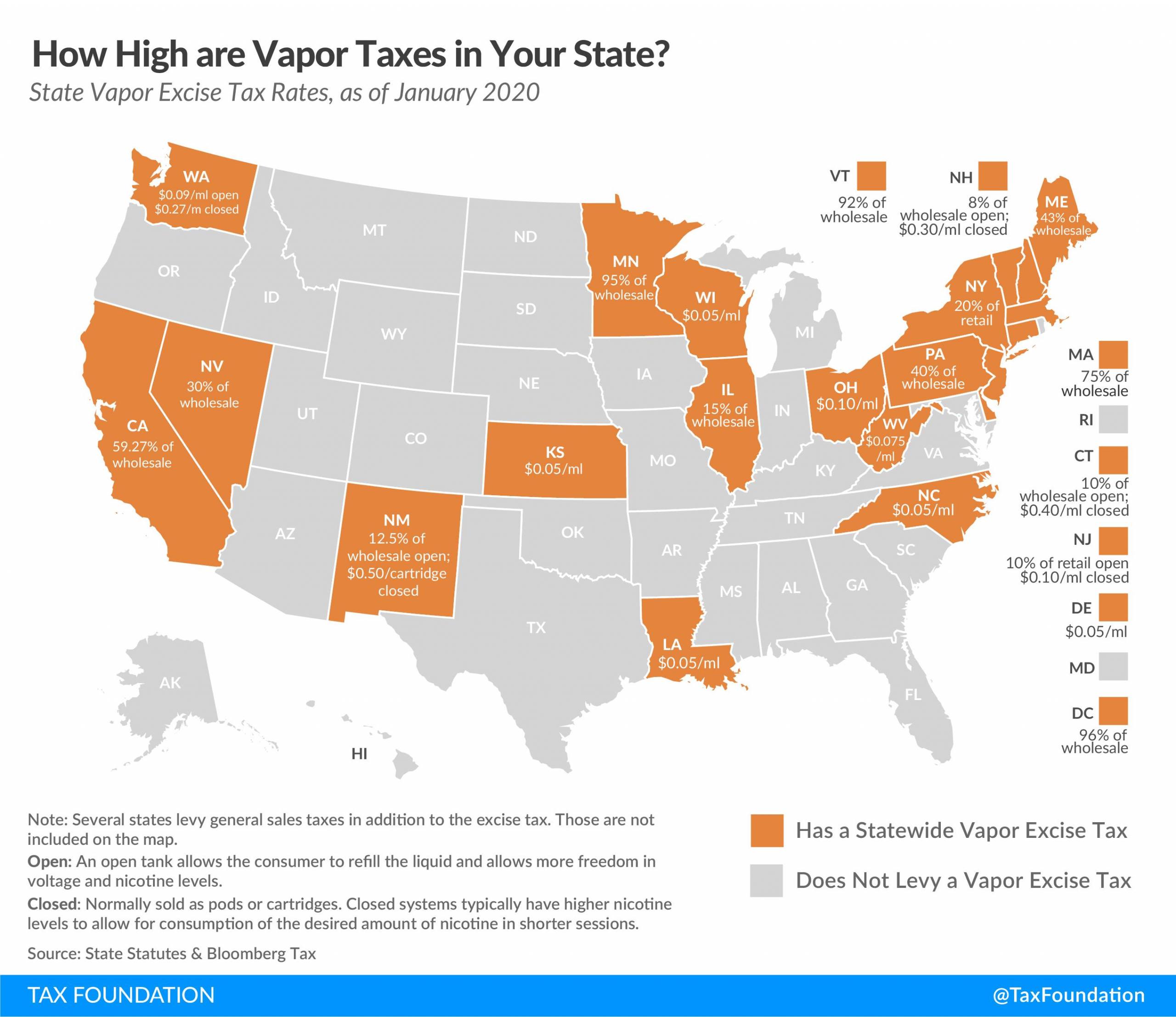

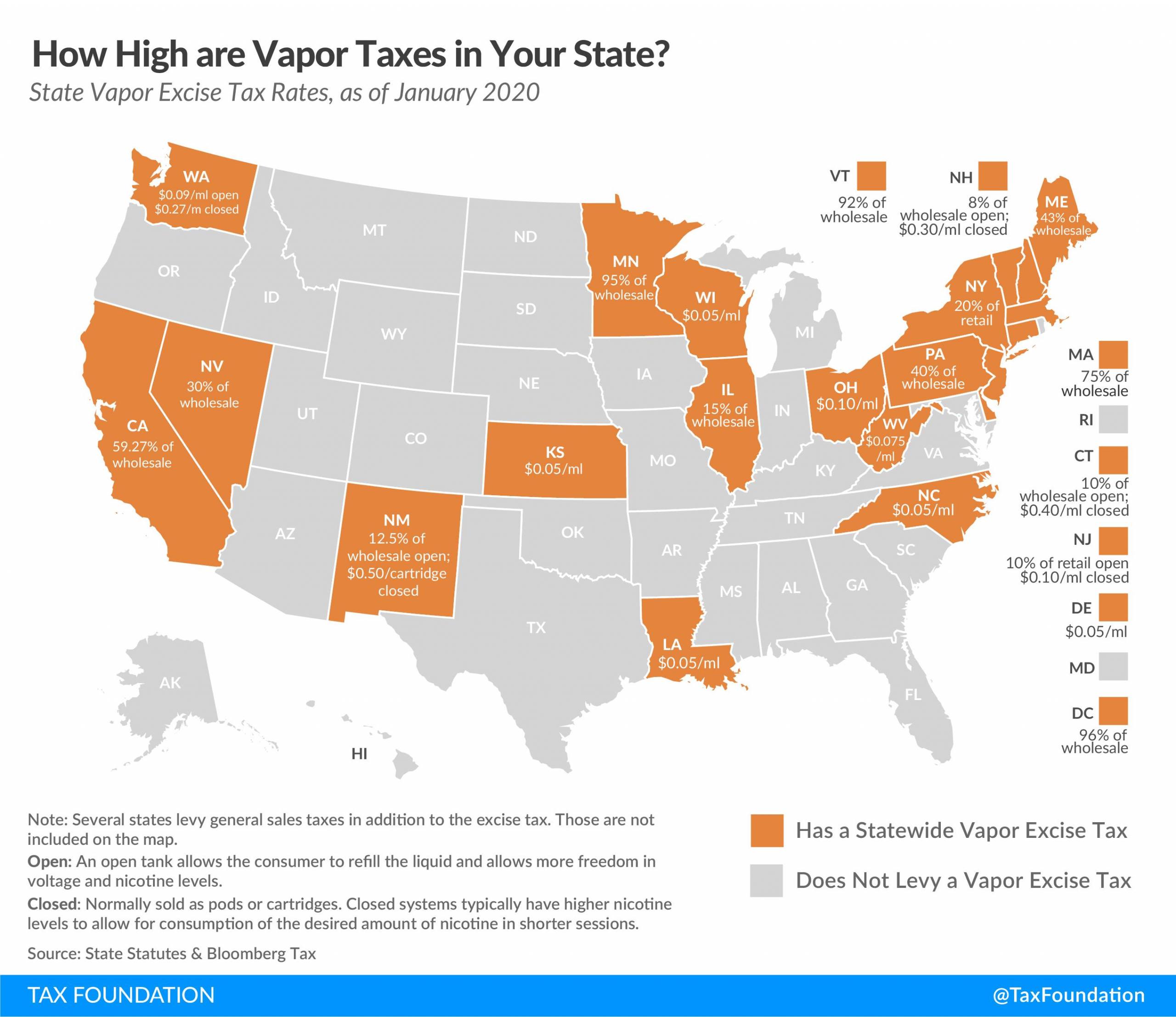

That said, the jurisdiction with the highest percent of wholesale tax rates is Minnesota at 95%. Kentucky has one of the highest per unit taxes at $1.50/closed system cartridge. Which State Has the Lowest Tax Rate? There are several states that do not have excise taxes on vaping products at all.

Do I have to pay tax on vapor products?

Yes. The vapor products tax applies to a liquid or other substance that functions as part of a vapor product or is sold with a vapor product as one packaged item, such as pods, cartridges, or pre-filled / disposable cigarettes. Applicable Laws and Rules

What is the new tax on vapor?

What is the tax rate for vapor products in Maryland?

What is the tax on nicotine in Virginia?

How much is the excise tax on nicotine?

How many people in Minnesota vaped?

What is specific excise tax?

When is the next vaping epidemic?

See 2 more

About this website

How is vaping taxed?

Beginning July 1, 2022, electronic cigarette retailers are required to collect from the purchaser at the time of sale, a California Electronic Cigarette Excise Tax (CECET) at the rate of 12.5 percent of the retail selling price of electronic cigarettes containing or sold with nicotine.

What states have a vape tax?

Vapor Taxes by State, 2022Indiana was the only state to add a tax to vaping products in 2022: 15 percent of the gross income received by retailers.California added a retail tax of 12.5 percent in addition to raising its tax to 61.74 percent on wholesale transactions.More items...•

What is the vape tax in Massachusetts?

a 75%As of June 1, 2020, all vaping products are subject to a 75% state excise tax on the wholesale price.

Is there a vape tax in Florida?

Smoke-free tobacco/snuff are subject to a state excise tax of 85% / wholesale price (including a 60% surcharge.) Vapor products do not have an additional state excise tax.

What states are Vapes banned in?

U.S. bans on flavored vapes and online salesArkansas – online sales ban. ... California – flavor ban (on hold until 2022) ... Maine – online sales ban. ... Massachusetts – flavor ban. ... New Jersey – flavor ban. ... New York – flavor ban + online sales ban. ... Oregon – online sales ban. ... Rhode Island – flavor ban.More items...•

Is vaping considered smoking?

Vaping is not smoking, but some people find vaping works to help them quit because it offers experiences similar to smoking a cigarette. Vaping has a similar hand-to-mouth action as smoking, and it can also be social.

Why is vaping banned in MA?

When did the ban go into effect? On September 24, 2019, Governor Baker declared a public health emergency in the Commonwealth due to severe lung disease associated with the use of e-cigarettes and vaping products and the epidemic of e-cigarette use among youth.

Is vaping still banned in Massachusetts?

The sale of flavored vape products has been banned in Massachusetts since June, 2020.

Can you ship vape products to Massachusetts?

Mail-order or internet sales of electronic smoking devices prohibited unless retailer requires age-verification and signature by person of legal sales age upon receipt.

Are vapes getting banned in Florida?

Currently, 19 localities in Florida ban the use of e-cigarettes in enclosed workplaces. These laws all include restaurants under the ban, but they also follow the example of the Clean Indoor Air Act and give an exemption to bars. Vaping is allowed for people who work outdoors.

What are the vaping laws in Florida?

Sale/distribution of nicotine dispensing devices or nicotine products to persons under age 21 (unless active duty military member) prohibited. Possession of nicotine dispensing devices or nicotine products by persons under age 21 (unless active duty military member) prohibited.

Are vape pens illegal in Florida?

Florida Laws on Possession of Drug Paraphernalia: In addition to possession of a controlled substance, state law prohibits possession of the implements used for ingesting, inhaling, or otherwise consuming drugs – including vape pens.

What is the vape tax in Oregon?

65 percentEffective January 1, 2021, inhalant delivery systems are taxed as tobacco products at 65 percent of the wholesale purchase price.

How much is vape tax in Pennsylvania?

E-cigarettes/Vapor products The tax rate for e-cigarettes is 40 percent of the purchase price from the wholesaler on the following: Electronic cigarettes — defined as an electronic oral device, such as one composed of a heating element and battery, electronic circuit or both.

Does Virginia have a vape tax?

"vape juice") will be subject to Virginia's tobacco products tax at a rate of 6.6¢ per milliliter. If your business sells liquid nicotine, how will this law change affect you?

Is there a vape tax in Indiana?

The new tax rate will be an added 15% of the wholesale price on all e-cigarette cartridges and vaping products. This tax is additional to sales tax, which is 7% in the state of Indiana. Currently, there are 30 other states with a statewide vape tax. Copyright 2022 Nexstar Media Inc.

How much excise tax is required for vaping in Maryland?

Maryland requires an excise tax equal to 12% of the retail price on the following: open-system devices, components, accessories, and liquids over 5ml. The excise tax on vaping liquids sold in a container that contains 5ml or less of vaping liquid is 60% of the retail price. Batteries and battery chargers are not subject to ...

What is the tax on vaping in Colorado?

The city of Boulder requires on all vaping products, including tobacco-free nicotine products, an excise tax that is equal to 40% of the retail price. Learn more here.

How much is a 5ml liquid taxed in New Mexico?

New Mexico requires that liquids over 5ml be taxed at 12.5% of the product value. This includes nicotine-free liquids. Closed-system cartridges—including disposables—under 5ml are taxed at rate of $0.50 per cartridge. You can read more here.

How much is nicotine taxed in New Jersey?

New Jersey. New Jersey requires that liquid nicotine be taxed at a rate of $0.10 per fluid milliliter by volume, and a proportionate rate on all fractional parts of a fluid milliliter (except container e-liquid). Container e-liquid must be taxed at a rate of 10% of the listed retail sale price.

What is the excise tax rate for electronic cigarettes in Connecticut?

Connecticut. Connecticut has mandated an excise tax on any electronic cigarette product at a rate of either $0.40 per milliliter of liquid that is pre-filled (including disposables) or 10% of the wholesale price of any other electronic cigarette product.

What is the excise tax for e-liquids in California?

California. California requires on e-liquids and tobacco-free nicotine products an excise tax that is equal to 63.49% of the wholesale price. Nicotine-free liquids are excluded from this tax. To learn more, please visit the California Department of Tax and Fee Administration's website here.

How much is vaping tax in Kentucky?

Kentucky. Kentucky requires a tax of $1.50 per closed vapor cartridge/pod regardless of nicotine content. Additionally, open vaping system devices, liquid (regardless of nicotine content), components (excludes batteries when sold separately), and accessories must be taxed at 15% of the retail price.

What does it mean when you don't see your state on Vapor?

If you do not see your state listed, that means they are not currently charging state and local excise taxes on vapor products. We will continue to update this page if and when additional states begin taxing vapor products.

What is the new tobacco law?

The effect of this new law broadens the definition of tobacco products to include electronic cigarettes, vapes, eLiquids and vaping accessories.

Where does the tax revenue go for smoking cessation?

Some states dedicate a portion of tax revenues to smoking cessation programs and health care. For many the revenue ends up in the general fund.

What is the difference between open and closed vaping?

Some states tax open and closed vaping products differently. Open: allows the user to refill the liquid and has more freedom in voltage and nicotine levels. Closed: Usually sold as pods or cartridge. Closed systems often have higher nicotine levels to allow for consumption of the desired amount of nicotine in shorter sessions.

Which state has the highest wholesale tax rate?

That said, the jurisdiction with the highest percent of wholesale tax rates is Minnesota at 95%.

Do you pay taxes on e-cigarettes?

There are currently no federal excise taxes on e-cigarettes. They could be coming soon though. There is already federal legislation affecting sellers of vaping products. Federal vape taxes could be next.

Which states have the lowest alcohol tax?

Delaware, Kansas, Louisiana, North Carolina, and Wisconsin are also some of the lowest at $0.05/ml.

Does New Hampshire have a tax on vaping?

There are several states that do not have excise taxes on vaping products at all. However, out of the states that do tax vaping products, one of the lowest is percentage-based taxes is New Hampshire at 8% of wholesale price for open vaping products.

How old do you have to be to sell vapes?

Retail stores: Must be licensed to sell non-flavored vape products with nicotine content less than 35 mg/ml. 21 years of age or older retail tobacco stores: Must be licensed to sell non-flavored tobacco products and non-flavored nicotine vaping products with or without nicotine content.

What is the phone number for the tobacco tax?

Call the Cigarette and Tobacco Excise Unit at (617) 887-5090.

What is a non-participating manufacturer?

A non-participating manufacturer (NPM) is a cigarette manufacturer that is not a party to the Tobacco Master Settlement Agreement.

When will flavored tobacco be available in stores?

Flavored tobacco products such as menthol cigarettes, flavored cigars and flavored chewing tobacco can be sold in retail stores until June 1, 2020. As of that date, flavored tobacco and flavored vaping products may be purchased and consumed only at licensed smoking bars.

When do cigarette licenses expire?

Most cigarette licenses must be renewed by June 30 of each year. However, retailer licenses are valid for two years. They expire on September 30 of each year ending in an even digit (e.g., 2012 and 2014).

Can you sell non-flavored vapes?

Retail stores, such as convenience stores, gas stations and other retailers may only sell non-flavored nicotine vaping products provided the nicotine content is 35 mg/ml or less. Non-flavored nicotine vaping products, with nicotine content more than 35 mg/ml can be sold only at retail tobacco stores or smoking bars to buyers 21 years of age or older.

Who administers tobacco taxes in Massachusetts?

Here you will find answers to frequently asked questions regarding Cigarette, Tobacco and Vaping Excise taxes administered by the Massachusetts Department of Revenue (DOR).

How much is the tax on vapor products?

The tax is imposed on the sale, offering or exposing for sale, possession with intent to sell or removal for consumption or other disposition for any purpose of vapor products at the rate of 5 cents per milliliter of the liquid or other substance based on the volume listed by the manufacturer and at a proportionate rate for any other quantity or fractional part thereof. The tax is due at the time of receipt of untaxed product within the state.

When are Vapor products tax returns due?

The tax first applies to vapor products received by distributors on or after October 1, 2019. The first monthly return is due November 15, 2019.

How to apply for a distributor's permit for vapor products?

Distributors of vapor products that do not currently hold a tobacco distributor permit must apply for a permit by completing Form CTP-129, Cigarette and Tobacco /Vapor Products Permit, found on the Cigarette, Tobacco and Vapor Products Forms page.

What is a vapor product?

Stats., "vapor product" means a noncombustible product that produces vapor or aerosol for inhalation from the application of a heating element to a liquid or other substance that is depleted as the product is used, regardless of whether the liquid or substance contains nicotine.

Do you have to report a vapor product to the end user?

If you hold a tobacco and vapor products distributor permit and sell vapor products at retail to the ultimate consumer of the products, you are not required to report your sales of vapor products disbursed to an end user (transaction code 2C) on TT-101.

Can you file a tax return with XML?

Yes, the MTA filing method cannot be used for returns with more than 32,000 transaction rows. If your return has more than 32,000 transaction rows, must file via XML. For more information regarding the schema necessary to program an XML file, visit the Excise Tax e-File Cigarette, Tobacco, and Vapor Products Uniformity Program page.

Do you pay tax on vapor in Wisconsin?

Yes, you owe use tax on vapor products that you use or store in Wisconsin at the rate of 5 cents per milliliter of the liquid or other substance that is depleted as the product is used, regardless of whether the liquid or substance contains nicotine.

What is the new tax on vapor?

Currently, California taxes 59.27 percent of wholesale cost. The new tax would add $1 per 20 milligrams of nicotine in a product. Governor Gavi Newsom (D) proposes that revenue from the new tax should be allocated to a fund and be spent on enforcement, youth prevention, and health care. Taxing based on nicotine content is problematic as it leads to non-neutral treatment of several nicotine products.

What is the tax rate for vapor products in Maryland?

Maryland. HB732 would impose a wholesale tax on vapor products at a rate of 86 percent —higher than almost all other states with vapor taxes. The bill would also allow local governments to add additional taxes on tobacco products—currently not allowed in Maryland. In addition to these two provisions, HB732 imposes a one-time floor tax—an excise tax ...

What is the tax on nicotine in Virginia?

Virginia. A budget amendment would introduce a tax of $0.066 per milliliter of liquid nicotine. Besides having updated its tax definitions to reflect the market, Virginia is also considering a specific excise tax at a relatively low level. Specific excise taxes are levied based on quantity such as weight or volume.

How much is the excise tax on nicotine?

Last month, a small majority in the House of Representatives approved a measure that bans all flavored tobacco and vapor products and imposes an excise tax ($50.33 per 1,810 milligrams of nicotine) on nicotine (unless that nicotine is an ingredient in an FDA-approved smoking cessation product).

How many people in Minnesota vaped?

A study that looked at the effect of vapor taxes in Minnesota concluded that 32,400 fewer people vaped as a result of the tax. Unfortunately, the 32,400 people who would have vaped if Minnesota did not have a high tax on vaping never quit smoking much more harmful cigarettes.

What is specific excise tax?

Specific excise taxes are levied based on quantity such as weight or volume. Specific taxes are not only the traditional way to levy excise taxes, they are also the best way to tax vapor products. Specific excise taxes are more neutral, more equitable, and more stable.

When is the next vaping epidemic?

March 11, 2020. Ulrik Boesen. Ulrik Boesen. The vaping “epidemic” has made many headlines over the last few years, starting with the dramatic increase in experimental vaping by high school students and last year due to the EVALI health crisis (e-cigarette or vaping product use-associated lung injury).

California

Colorado

- There are at least nine ballot initiativesin circulation seeking to increase tobacco taxes. The measures differ on whether they designate to earmark the revenue for a specified program. Appropriating revenue raised from vapor taxes to fund government programs related to the negative externalities associated with vaping can be sound tax policy, but collections from excis…

Maryland

- HB732would impose a wholesale tax on vapor products at a rate of 86 percent—higher than almost all other states with vapor taxes. The bill would also allow local governments to add additional taxes on tobacco products—currently not allowed in Maryland. In addition to these two provisions, HB732 imposes a one-time floor tax—an excise tax on existing...

Michigan

- Michigan’s SB781 would, if enacted, levy a tax of 24 percent on consumable materials used in vapor products. The revenue would be allocated to Michigan’s general fund. While the rate is significantly lower than in the Maryland and Colorado proposals, it shares the design flaw of levying the tax based on price as well as defining vapor products as tobacco products. In additio…

New Hampshire

- The House approved HB1699in early March. This bill would, if enacted, change the design of the current tax structure and increase tax rates. Currently, New Hampshire taxes vapor products in a bifurcated system, with an 8 percent rate on open systems (refillables) and a tax of $0.30 per milliliter on closed cartridge systems. HB1699 would convert this bifurcated regime into a 40 pe…

Utah

- SB37 passed the Senate in early March. The tax is 56 percent of wholesale price. The bill does a better job at defining vapor products outside the tobacco category but doesn’t escape problematic taxation due to the reliance on price. For instance, a bundled or prefilled product would be taxed on the full value while devices sold separately would only pay the general sales t…

Virginia

- A budget amendmentwould introduce a tax of $0.066 per milliliter of liquid nicotine. Besides having updated its tax definitions to reflect the market, Virginia is also considering a specific excise tax at a relatively low level. Specific excise taxes are levied based on quantity such as weight or volume. Specific taxes are not only the traditional way to levy excise taxes, they are als…

Final Thoughts

- According to the backers of these proposals, new or higher taxes would reduce both youth and adult vaping. Researchbacks up this claim. A study that looked at the effect of vapor taxes in Minnesota concluded that 32,400 fewer people vaped as a result of the tax. Unfortunately, the 32,400 people who would have vaped if Minnesota did not have a high tax on vaping never quit s…